Save time & drive business growth

Make strategic decisions faster, save precious time, and focus on what really matters - growing your business.

Trusted by small business owners, operators and franchisees across America

Reconcile saves business owners time and money

16

hours1,867

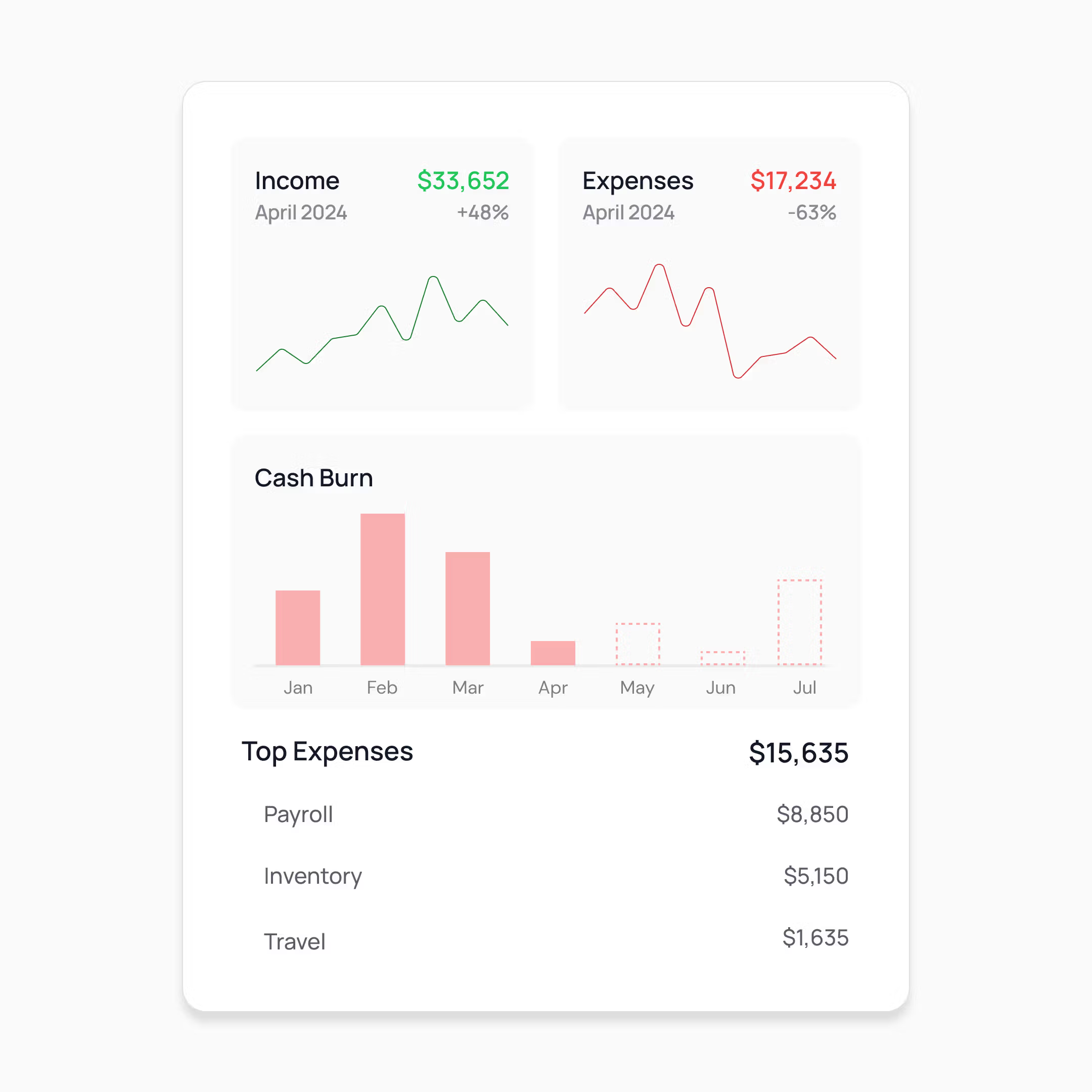

Real-Time Financial Dashboard

Connect your QuickBooks and transform your financial data into a live, actionable dashboard. Get instant access to key financial metrics and make informed decisions on the go.

Compliance & Tax Alerts

Never miss a deadline with automated state and federal compliance and tax alerts tailored to your business information. Stay ahead, avoid penalties, and ensure peace of mind.

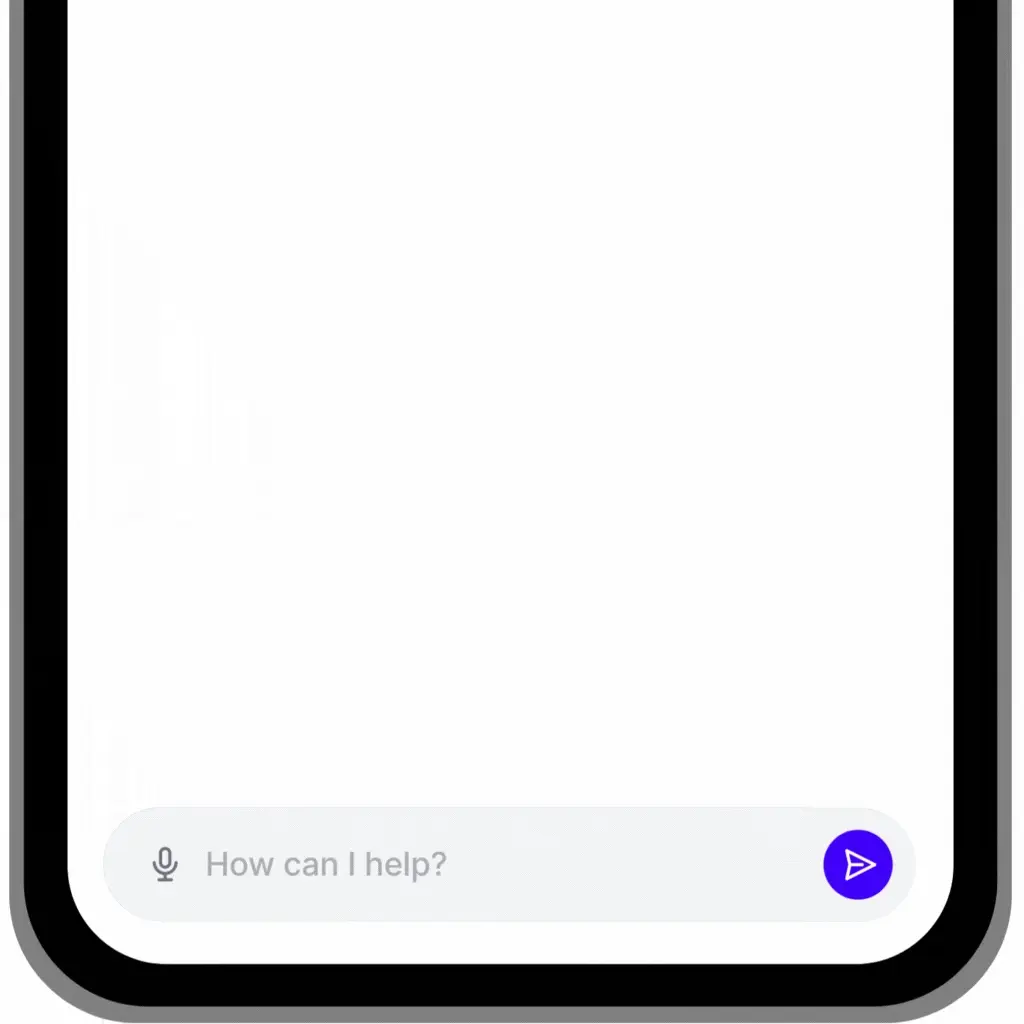

AI-Powered Business Advisor

Ask our AI-chatbot any finance or business question. Receive personalized recommendations based on your industry and business goals, making it feel like you have a CFO on call 24/7.

Why business owners love us

One easy plan for everyone

Get started with a free, seven-day trial.

Reconcile Premium

$ 30 / month

Pay $30/month for every Quickbooks account you connect to Reconcile.

- Real-time financial dashboard

- On-demand financial statements

- Live AI-chat support

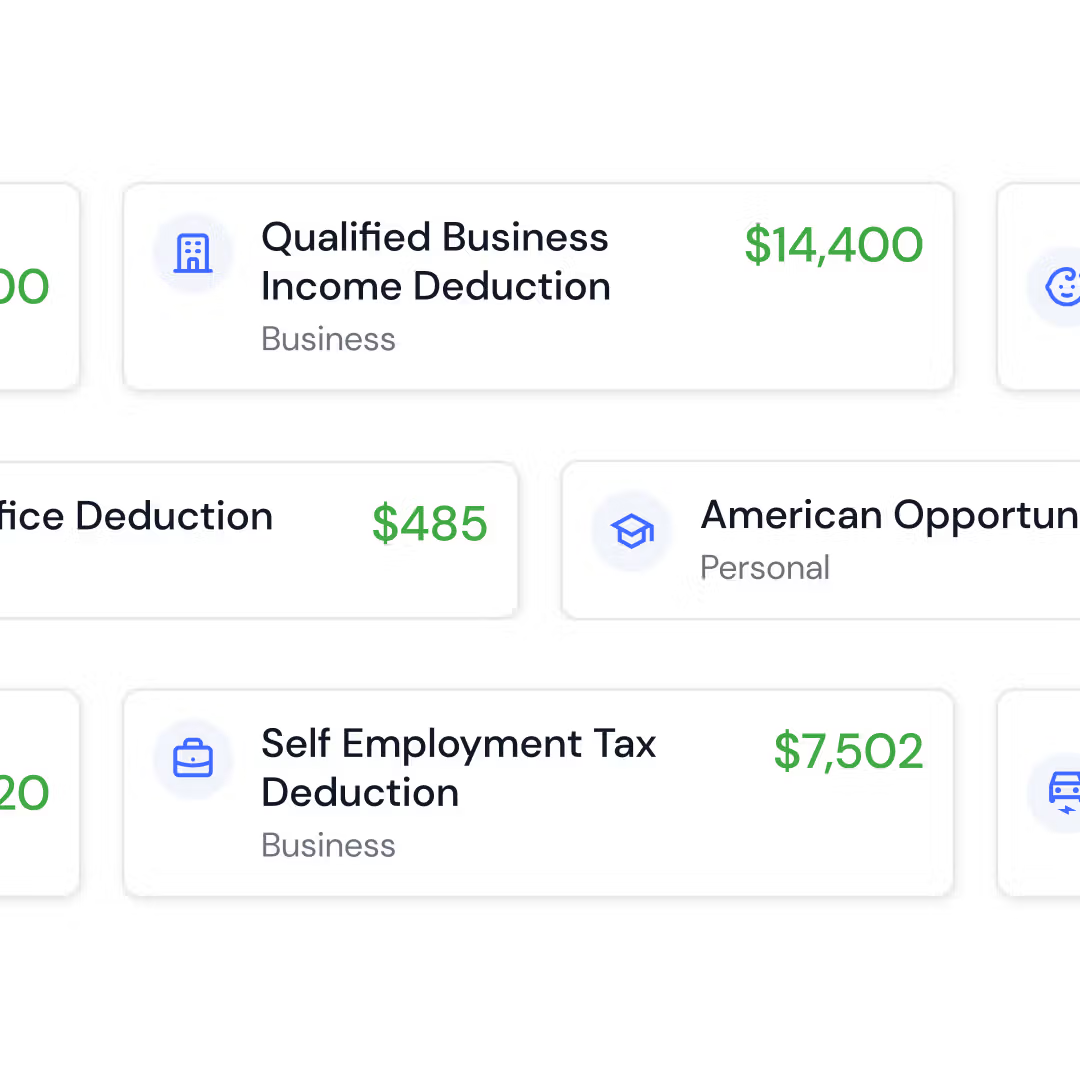

- Personalized tax tips

- Integration with Quickbooks

Frequently asked questions

Can I get a refund if I'm not happy with the service?

Yes you can. We offer a seven day free trial and a thirty day money back policy once you start your subscription. However, you won't be able to download your reports until you start a paid subscription.

How do I get started?

Simply connect your QuickBooks account and provide some basic business info. Our platform does the rest, synthesizing data into a real-time dashboard.

Is my financial data secure?

Your data's security is our top priority. We use state-of-the-art encryption and comply with all relevant data protection regulations to keep your information safe.

Is Reconcile for small business owners, financial professionals or both?

Reconcile is designed to help small business owners, financial planners, accountants, and anyone else that wants to improve their own or their client's business performance.